Market Data

14 May 2021

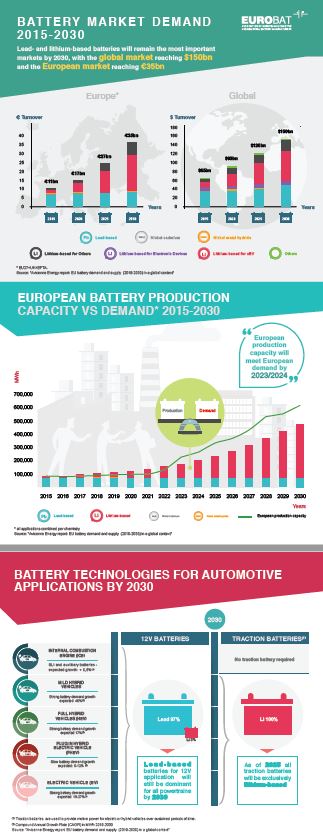

Avicenne study: “EU battery demand and supply (2019-2030) in a global context” shows that in the next decade lead and lithium batteries are critical to clean energy transition

- Li-ion and lead-based batteries will be the two mainstream technologies by 2030 and both are required to serve the anticipated increase in demand and the different applications

- The EU lead-based battery industry will maintain a strong position and will be able to meet projected growth, but ongoing investments in R&D and production enhancement are required

- The European Li-ion battery industry will have the capacity to serve growing demand from 2023/24.

- EU battery market value to grow from EUR 15bn in 2019 to an estimated EUR 35bn in 2030.

EUROBAT – the association of European Automotive and Industrial Battery Manufacturers – is today releasing the “EU battery demand and supply (2019-2030) in a global context” independent market report, produced by leading energy consultancy Avicenne Energy.

The study covers the mainstream battery technologies on the market today – lead-, lithium-and nickel-based technologies – plus a number of other chemistries, and covers “automotive” (12V and xEv) as well as “industrial” (stationary and motive) applications

The key conclusions for automotive applications are:

- Across all levels of e-mobility, lead-based batteries will continue to be dominant in the 12V market – both for SLI (start, lighting, ignition) and auxiliary functionalities. By 2030, it is estimated that only 3% of new cars will be fitted with a lithium 12V battery.

- For xEV traction batteries, lithium-based batteries will remain the exclusive chemistry.

For industrial batteries, the main takeaways can be summarised as follows:

- For UPS (Uninterruptible Power Supply) and Telecom applications, lead-based batteries will still be dominant in 2030.

- For Energy Storage Systems (ESS), the preferred technology will be almost exclusively lithium-based by 2030.

- For Motive Power applications, where lead-based batteries are today still dominant, will gradually shift to lithium-based by 2030.